As the world watches the escalating tensions in the Middle East, the Indian stock market is bracing itself for a potentially volatile trading session. A combination of weak global cues, driven by geopolitical concerns, and mixed economic data from key regions is creating a challenging environment for investors.

Asian Markets: Cautious Trading

Asian markets opened with a cautious approach on Tuesday, reflecting concerns over the ongoing conflict between Israel and Iran. Investors are seeking stability as they navigate this complex geopolitical landscape. The major indices in the region saw significant declines:

- Japan’s Nikkei 225 dropped by 1.5%, and the Topix index was down by 1.04%.

- South Korea’s Kospi fell by 1.31%, while the Kosdaq also dipped by 0.86%.

- Hong Kong’s Hang Seng index is expected to open weaker as well.

These declines indicate a risk-off sentiment among investors, likely influenced by the ongoing situation in the Middle East.

Gift Nifty Signals Weak Opening

Gift Nifty, the indicator for the Indian stock market’s opening, was trading around the 22,185 level, representing a nearly 180-point discount from the Nifty futures’ previous close. This suggests a weak start for the Indian indices and points to an extension of recent losses.

Wall Street Retreats on Rising Yields and Geopolitical Concerns

Overnight, US markets experienced a significant downturn. All major indices ended sharply lower amid a combination of rising Treasury yields and geopolitical tensions:

- The Dow Jones Industrial Average fell by 248.13 points (0.65%) to 37,735.11.

- The S&P 500 dropped 61.59 points (1.20%) to 5,061.82, falling below the critical 5,100 level.

- The Nasdaq Composite lost 290.07 points (1.79%) to close at 15,885.02.

Losses in technology giants like Apple, Tesla, Nvidia, and Microsoft contributed significantly to the decline, highlighting the risk-off sentiment among investors. The volatile session was offset somewhat by gains in financials such as Goldman Sachs and M&T Bank.

China’s Q1 GDP Surpasses Expectations

China’s economy showed resilience in the first quarter, expanding by 5.3% year-on-year, beating analysts’ expectations of 4.6%. This robust performance is a positive signal for the global economy, especially as China continues to recover from the effects of the pandemic.

On a quarter-by-quarter basis, China’s GDP grew by 1.6%, surpassing the forecast of 1.4%. This solid performance may provide some support for global markets, although geopolitical tensions continue to overshadow economic data.

US Retail Sales: Surprising Growth

In the US, retail sales surged in March, rising 0.7% compared to February’s revised growth of 0.9%. Economists had expected a 0.3% increase, so the stronger-than-expected data is a positive sign for the US economy.

The upbeat retail sales data boosted Treasury yields, with the benchmark 10-year yield hitting five-month highs. The 10-year Treasury note yield rose to 4.628%, while the 30-year bond yield reached 4.739%. The two-year US Treasury yield climbed to 4.935%.

India’s Trade Deficit Narrows

India’s trade deficit in March narrowed to $15.6 billion, marking an 11-month low and representing a 17% reduction from February’s deficit. This improvement exceeded expectations and could offer some relief to the Indian economy.

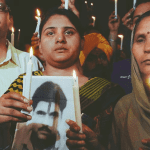

Oil Prices Firm Amid Middle East Tensions

Brent crude oil rose by 0.54% to $90.59 a barrel, while US West Texas Intermediate (WTI) crude futures gained 0.57% to $85.90. The increase in oil prices can be attributed to the elevated geopolitical tensions in the Middle East, particularly in light of Israel’s anticipated response to the attack by Iran.

Yen Hits 34-Year Low

The Japanese yen has reached its lowest level since 1990 against the US dollar, with the dollar index climbing to its highest point since November 2, 2021. Japan’s finance minister has indicated readiness to take necessary measures in the foreign exchange market if the yen’s decline continues.

Investors in the Indian stock market should brace for increased volatility in the near term as global cues remain mixed and geopolitical tensions in the Middle East persist. The ongoing earnings season and political developments in India are also likely to contribute to sector-specific and stock-specific action in the market.

In these uncertain times, it is essential for market participants to remain vigilant and adopt a cautious approach to navigating the shifting landscape.