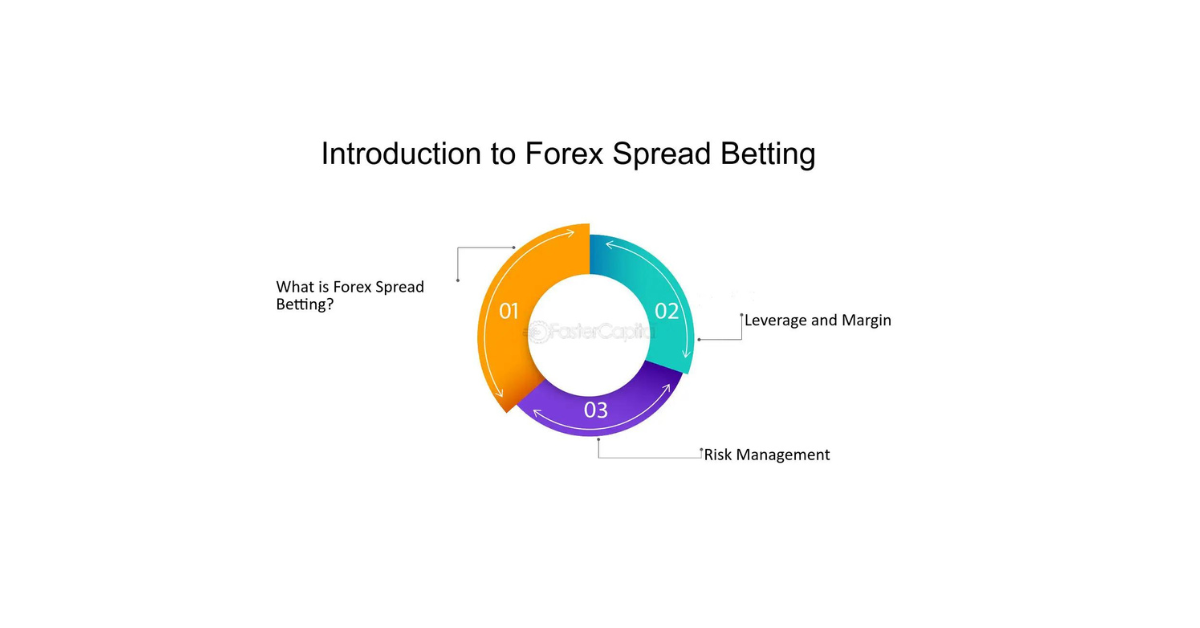

Understanding Spread Betting

Spread betting is a form of derivative trading that allows investors to speculate on the price movements of various financial markets without owning the underlying asset. Instead of buying the asset itself, traders place bets on whether they believe the price of the asset will rise or fall. The profit or loss is determined by how accurate their prediction is and the size of their bet.

In spread betting, the trader is not required to outlay the full value of the trade, but instead, they deposit a margin amount with their broker. This leverage allows traders to take larger positions in the market than their initial deposit would typically allow. It is important to note that while leverage can amplify profits, it can also lead to increased losses, making risk management a crucial aspect of spread betting.

Advantages of Spread Betting in Forex

Spread betting in Forex offers several advantages to traders. Firstly, one key benefit is the ability to speculate on the price movements of currency pairs without actually owning the underlying asset. This allows for greater flexibility in trading as traders can profit from both rising and falling markets.

Another advantage of spread betting in Forex is the potential for leveraged trading. By trading on margin, traders can control larger positions with a smaller amount of capital, amplifying potential profits. However, it’s essential to remember that leverage also increases the risks involved in trading, so it should be approached with caution and proper risk management strategies in place.

Choosing the Right Broker for Spread Betting

When selecting a broker for spread betting, it is crucial to consider credibility and regulation. Opt for brokers who are regulated by reputable financial authorities, as this provides a level of security and protection for your funds. Ensure the broker has a solid track record in the industry to avoid potential pitfalls.

Additionally, look into the trading platform offered by the broker. A user-friendly platform with advanced charting tools can enhance your spread betting experience, enabling you to make well-informed trading decisions efficiently. Evaluate the platform’s features, responsiveness, and compatibility with your trading style to determine if it meets your requirements.

Developing a Spread Betting Strategy for Forex

When developing a spread betting strategy for Forex, it is essential to begin by conducting thorough market research. Understanding the intricacies of the currency pairs you are trading, as well as the factors that influence their movements, is crucial. Analyzing historical data, economic indicators, and geopolitical events can help you make more informed decisions when placing spread bets.

Furthermore, it is advisable to set clear and achievable goals when devising your spread betting strategy. Decide on your risk tolerance, profit targets, and time horizons before entering any trade. By having a well-defined plan in place, you can streamline your trading process and reduce impulsive decision-making, ultimately increasing your chances of success in the competitive world of Forex spread betting.

Managing Risk in Spread Betting

When engaging in spread betting, managing risk is paramount to protect your capital. One effective strategy is to set stop-loss orders to automatically close a trade at a predetermined price level. This helps limit potential losses and prevents emotions from taking over during volatile market conditions.

Diversification is another key element in managing risk in spread betting. By spreading your investments across different currency pairs, you can reduce the impact of a single market move on your overall trading account. Additionally, staying informed about market news and economic indicators can help you anticipate potential risks and make more informed trading decisions.