The ongoing conflict between Israel and Iran is causing significant concern for global stock markets and economies. The increasing tensions in the region, which is responsible for around a third of the world’s crude oil production, are leading to fears of an escalation that could drive up crude oil prices and inflation, potentially causing volatility in equity markets worldwide, including in India.

Impact on Crude Oil Prices and Inflation

The conflict has already resulted in a sharp rise in crude oil prices, with the price of Brent crude increasing by over 19% since the start of the year. As the situation continues to unfold, any further escalation may drive crude oil prices even higher, contributing to increased inflation rates.

Effects on Global Equity Markets

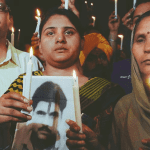

The potential escalation of the conflict may increase volatility in global equity markets, including those in India. The seizure of an Israeli-affiliated container ship by Iranian commandos and other retaliatory actions have the potential to disrupt trade and increase uncertainty.

Shrey Jain, Founder and CEO of SAS Online, warns that increased tensions may lead to an uptick in inflation and could negatively impact stock valuations, particularly in India where stocks are not currently trading at low valuations. Jain also notes that domestic exporters may face increased costs, affecting their margins.

Defensive Plays and Investment Strategies

As a result of the ongoing conflict, certain sectors and defensive plays may become more appealing to investors. Manoranjan Sharma, Chief Economist at Infomerics Ratings, suggests that domestic power sector and pharmaceutical stocks may provide stability during this volatile period. Additionally, he points out that select large-cap capital goods, defense, and infrastructure stocks may be worth considering at lower levels.

On the other hand, stocks of oil marketing companies could face challenges due to sustained high crude oil prices, lower margins, and an inability to pass on higher prices ahead of elections.

Geopolitical Uncertainty and Safe-Haven Assets

The geopolitical uncertainty has led to a rush into safe-haven assets, particularly gold. Gold prices have jumped significantly, rising by over Rs 1,000 to reach Rs 72,931 per 10 grams on Friday, driven largely by the escalating tensions. Despite the sharp increase in gold prices, the overall trend in gold remains bullish, with strong support seen at Rs 70,000, according to Jateen Trivedi, VP Research Analyst-Commodity and Currency at LKP Securities.

As the conflict between Israel and Iran unfolds, the potential for further escalation remains a concern. Market watchers and experts believe that this uncertainty may lead to difficult days ahead for global stock markets and economies. Investors are advised to monitor the situation closely and consider defensive plays and safe-haven assets such as gold during this volatile period. The stance of the U.S. government in this situation may also play a significant role in determining the direction of the conflict and its impact on global markets.