Understanding Spread Betting

Spread betting is a popular form of derivative trading that allows investors to speculate on the price movements of various financial instruments. Unlike traditional forms of trading where you buy or sell an asset at a fixed price, spread betting enables traders to profit from both rising and falling markets. Essentially, spread betting involves placing a bet on whether you think the price of an asset will increase or decrease from its current value.

In spread betting, you do not own the underlying asset and instead, you are simply speculating on the price movement of the financial instrument. The profit or loss you make is determined by how accurate your prediction is. If the market moves in your favor, you stand to make a profit, but if it moves against you, you will incur a loss. Spread betting offers traders the opportunity to leverage their positions, meaning they can control a larger position with a smaller amount of capital, amplifying both potential profits and losses.

Key Terminology in Spread Betting

Spread betting involves a range of specific terminology that traders must familiarize themselves with to navigate the market effectively. One key term is “spread,” which refers to the difference between the buying (ask) price and the selling (bid) price of an asset. This spread represents the cost of the trade and is how brokers generate revenue.

Another crucial term is “margin,” which is the amount of money traders must deposit with their broker to open a position. Margin requirements vary depending on the asset being traded and the level of leverage employed. Traders should always be mindful of their margin levels to avoid margin calls or potential liquidation of their positions. Understanding these essential terms is fundamental to successful spread betting and can help traders make informed decisions in a volatile market.

The Mechanics of Spread Betting

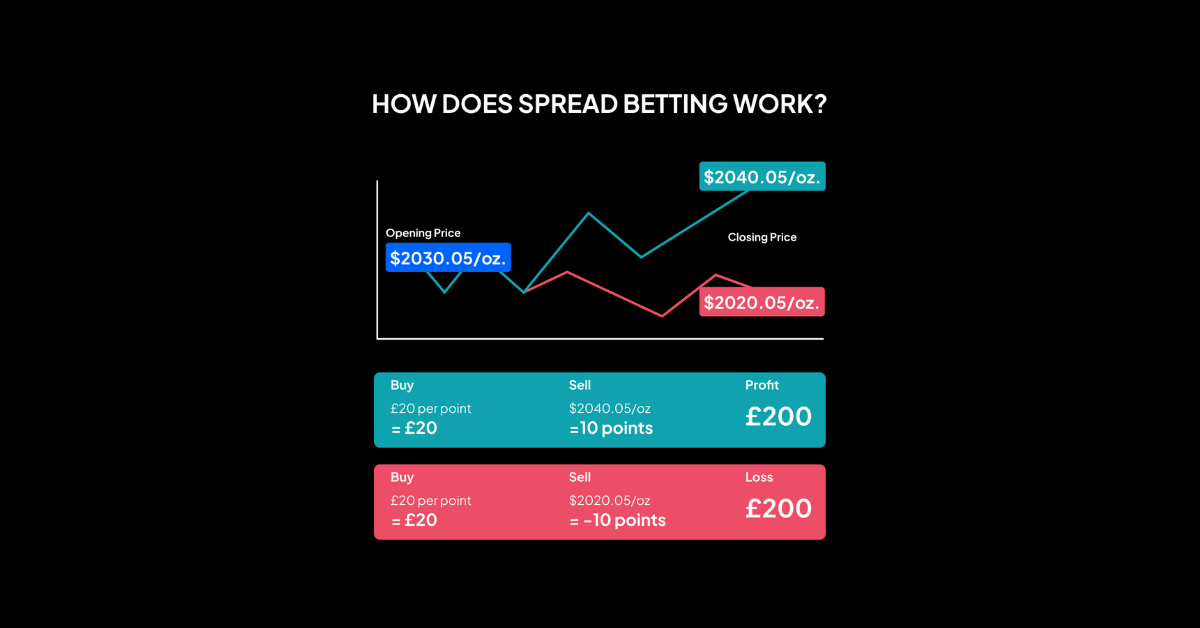

Spread betting involves speculating on the movement of financial markets without owning the underlying asset. Traders place bets on whether the market will rise or fall, and the level of profit or loss depends on how accurate their prediction is. The basic idea is that traders make a profit for every point the market moves in their favor, but also incur losses for every point it moves against them.

In spread betting, the bid price is the selling price and the ask price is the buying price. The difference between these prices is known as the spread, which represents the broker’s profit margin. Traders can choose to go long (buy) if they predict the market will rise, or go short (sell) if they expect it to fall. The position size is determined by the stake per point, which allows traders to control their risk exposure and potential returns.

Benefits of Spread Betting

Spread betting offers traders the potential for high returns due to the use of leverage. This means that an investor can control a large position with a relatively small deposit, amplifying potential profits. However, it is crucial to remember that leverage can work both ways, magnifying losses as well.

Another key benefit of spread betting is the ability to go short on a market. This means that traders can profit from falling prices by selling assets they don’t currently own. In traditional forms of investment, such as buying stocks, the ability to profit from a falling market is limited. By being able to go short, spread betting allows for more diverse trading strategies and opportunities for profit.

Risks Associated with Spread Betting

While spread betting can offer considerable profit potential, it also comes with inherent risks that traders need to be aware of. One of the primary risks of spread betting is the high volatility of the financial markets. Prices can fluctuate rapidly, potentially leading to significant losses if the market moves against your position. This volatility can be exacerbated by external factors such as economic news, geopolitical events, and corporate announcements.

Another risk associated with spread betting is the concept of leverage. Leverage allows traders to control a large position with only a fraction of the total value deposited. While this can amplify profits, it also magnifies losses. It’s crucial for traders to understand the risks involved with leveraging and to carefully manage their positions to avoid substantial financial setbacks. Trading with leverage requires a disciplined approach and a thorough understanding of the markets to mitigate the potential risks.