In an effort to circumvent Western sanctions and evade taxes, Russian Copper Company (RCC) and Chinese firms have been engaging in trade activities involving copper wire rod disguised as scrap, three sources familiar with the matter told Reuters. This strategy of disguising new copper wire rod as scrap allows both exporters and importers to profit from discrepancies in tariffs applied to new metal and scrap materials.

Shredding Copper Wire Rod

The process involves shredding newly made copper wire rod in the remote Xinjiang Uyghur region by an intermediary to make it resemble scrap. Copper wire rod, often used in making power cables, is typically coiled for ease of transport, while copper scrap is a mix of used wires, tubes, and pipes. The shredding of new copper wire rod into grain-sized pieces or coiled and pressed packs renders it hard to distinguish from scrap, thus allowing Russian exporters and Chinese importers to take advantage of the lower duties on scrap.

Trade Discrepancies

The sales of new copper rod disguised as scrap began in December 2023, leading to noticeable discrepancies between Chinese and Russian data. While Chinese customs data showed significant increases in copper scrap imports from Russia since December, Russian figures obtained from a commercial data provider showed minimal scrap exports. This suggests that new copper wire rod is being relabeled as scrap for export.

In December, Chinese companies made five purchases of products labeled as “copper rod” from RCC’s plant in the Urals region through an intermediary known as Modern Commodity Trading DMCC. These purchases amounted to around $65 million in revenue, according to a commercial data provider.

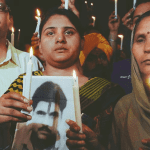

Challenges with Xinjiang Region and Sanctions

The Xinjiang region, where the copper wire rod shredding occurs, poses challenges for international observers due to restricted access stemming from international condemnation of the treatment of Uyghur populations. This restriction may have facilitated the concealment of these trade activities.

The shredding process not only allows exporters and importers to avoid taxes but also makes the material more difficult to trace, thereby facilitating its sale to Chinese manufacturers. Although there are no legal obstacles to prevent China from purchasing materials from Russian firms under Western sanctions, manufacturers may still be cautious about potential disruptions to their export business.

Russian Response and Chinese Imports

Russian customs has temporarily ceased providing data on foreign trade since April 2022, after Russia’s invasion of Ukraine. Consequently, the market now relies on commercial data providers for trade information. When Reuters inquired about discrepancies in trade data, Russian customs provided no response, citing a halt in providing foreign trade data.

Despite these complications, trade in copper wire rod from Russia to China has surged in recent months. In December 2023, Chinese customs data showed a significant rise in copper scrap imports from Russia, which predominantly passed through the Alashankou border in Xinjiang.

Impact on Chinese Copper Industry

This practice is seen as a potential boon for Chinese copper fabricators, particularly in Jiangsu and Zhejiang provinces, who can directly consume the material. The use of de facto copper rod disguised as scrap allows fabricators to sidestep tariffs and import high-quality copper at a lower cost.

The situation highlights the innovative yet dubious measures taken by Russian exporters and Chinese importers to navigate around Western sanctions and tax discrepancies. It also underscores the complexities and challenges of monitoring international trade in commodities like copper wire rod, especially when considering geopolitical and ethical concerns linked to specific regions such as Xinjiang.